[ad_1]

Sponsored by Parker Lord

Just over a decade ago, a report by IDTechEx predicted 1.5 million battery-electric vehicle (EV) sales by the start of 2021—a prediction seen by many as overly optimistic. Yet, it turned out to be a significant underestimate by more than half. And there is no sign of EV sales slowing in 2022. In fact, Bloomberg Green expects this growth to continue with more than 10 million plug-in vehicle sales this year—up from 6.6 million in 2021 and 3.2 million in 2020.

With the explosive growth anticipated in the coming years, here are five emerging EV trends which will determine the future of electrification and their impact on multiple industries.

1) Increased need to secure raw materials for EV batteries

The global appetite for EVs is increasing so rapidly that the supply chain is challenged to keep up. In particular, obtaining and refining necessary raw materials like lithium, nickel, and cobalt can be difficult. According to SupplyChainDive, lithium prices don’t support the required mining investment. Plus, the number of places where nickel can be refined is limited. The ideal solution to these challenges is the creation of a self-sustaining supply chain that supports the recycling and rescue of battery waste. This would lead to a reduced reliance on mining to obtain raw materials since they could be pulled from the waste and repurposed.

Another concern involves a lag in manufacturing the cells needed to make the batteries. Unlike a cellphone that needs only one battery cell, EVs require thousands of cells. A flourishing regional battery supply chain is vital for the automotive industry and cuts down on transportation emissions across the supply chain, something that is particularly important for an industry that prides itself on sustainability.

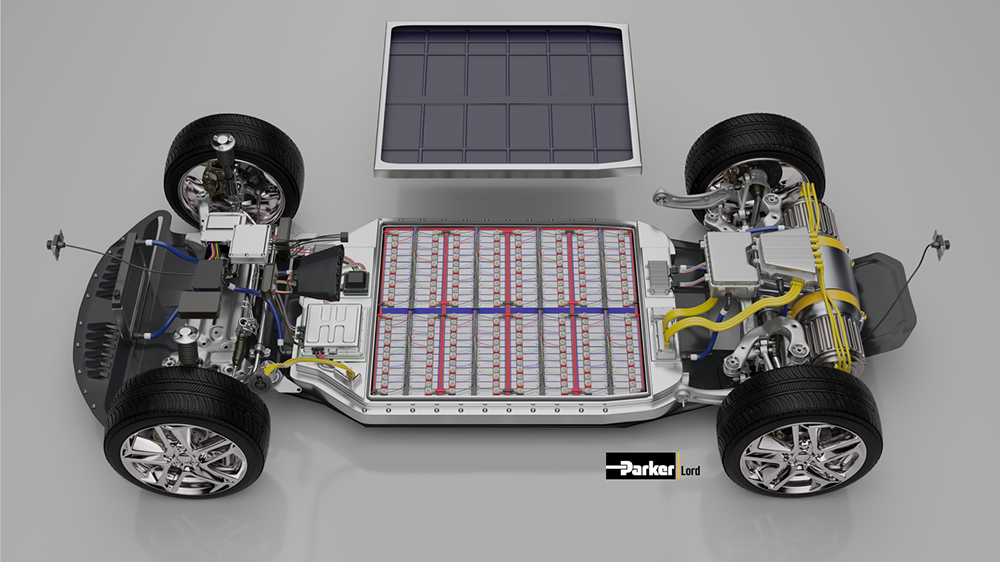

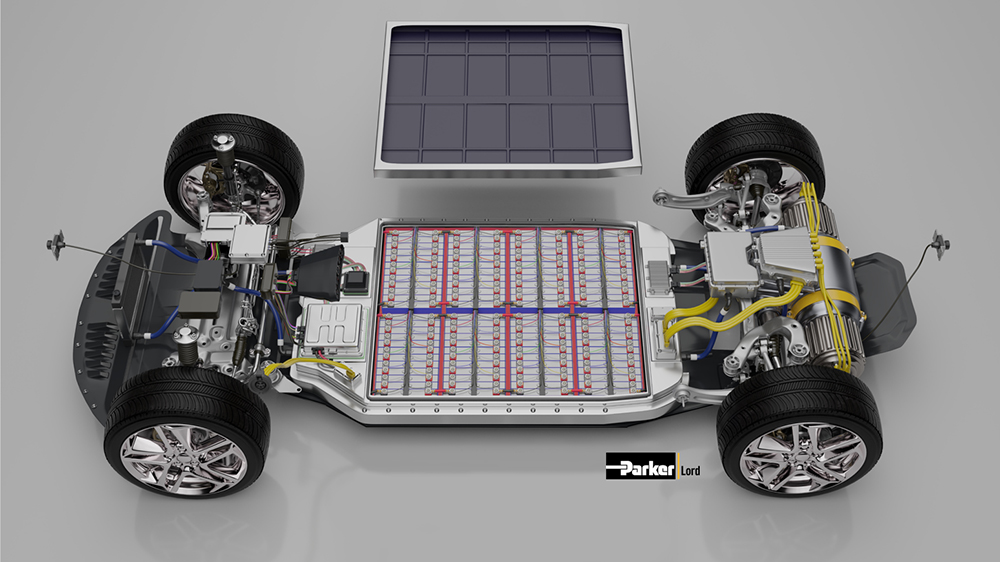

2) The shift from cell-to-module to cell-to-pack battery designs

EV manufacturers are seeking lighter weight, yet more compact solutions to gain additional energy density. At the same time, they are also striving for simplicity and affordability. OEMs and battery manufacturers are looking at both immediate and long-term solutions, including bonding individual cells directly to the cooling plate. This kind of design is known as Cell-to-Pack (CTP), which increases volume-utilization space, reduces the number of parts, improves pack energy density, and gives manufacturers the option to use less expensive and lower energy density cells.

In addition to reducing by half the number of thermal interface materials and their interfaces and eliminating module housing, CTP also significantly lowers the thermal resistance of the stack. This offers reduced cooling or heating loads by the cooling plate and enables the application of lower conductivity gap fillers.

According to IDTechEX, OEMs have begun transitioning to CTP. This fundamental change in battery pack structure leads to shifts in how thermal strategies and materials are incorporated, including thermal interface materials, coolant channels, and fire protection. For these solutions to be viable, new thermally conductive (TC) adhesive technology is needed, and Parker Lord is leading the way with TC adhesives designed for the next generation of CTP configurations.

3) Continued emphasis on increasing EV charging speed

As millions of EVs hit the roads in the next decade, the need for fast charging will surge. Charge point operators (CPOs) must differentiate themselves if they hope to stay competitive. According to McKinsey & Company, CPOs are beginning to face increasing competition from a range of new entrants and types of businesses, including energy companies and automotive OEMs, especially in the United States and Europe.

CPOs will need to invest heavily in an infrastructure that delivers more than 150 kilowatts an hour and is highly reliable. CPOs will also need to excel in customer experience, raise demand through partnerships, expand their network strategically, implement innovative methods to optimize throughput, and develop nonenergy adjacent revenue sources. Those who do will have a head-start in what is expected to play a key role in the future of transportation.

4) Electrification beyond traditional passenger vehicles

As cities are tackling major issues like emissions, congestion, and safety, they are introducing regulations and incentives to accelerate the shift to sustainability (McKinsey & Company). And the mobility industry is doing its part by introducing an array of transformational innovations designed for urban roads, such as mobility-as-a-service, advanced traffic management and parking systems, freight-sharing solutions, and transportation options on two or three wheels. The e-scooter is one example of an alternative to the traditional passenger vehicle that is rapidly growing in popularity. E-scooters are lightweight, carbon-efficient, and can maneuver easily through congested traffic. With EV technology becoming more affordable, e-scooters are now significantly cheaper to ride than other modes of transportation—and the up-front and operational costs for owners are greatly reduced.

New forms of e-mobility are not limited to ground travel. We are seeing electric air travel take off at great speed. An excellent example of this is the “Spirit of Innovation” from Electroflight, a Parker Lord customer. However, this success is just the beginning. Predictions of electric air flight’s global market share show growth to USD 27.7 billion by 2030. Fueling this expansion is the rising demand for cleaner and quieter aircraft. Despite enduring challenges like the onset of the pandemic to the need for higher energy-density batteries, electric flight appears to be expanding into the next year and beyond.

On a similar strain, marine transportation is leaning toward an electric future. According to Rasso Bartenschlager, maritime travel accounts for roughly 3% of greenhouse gas emissions. To combat this, governments and companies are pushing to electrify marine equipment. A company leading the way for the electrification of marine equipment is Volvo Penta, specifically concerning its work on electric drivelines. With their acquisition of marine battery company ZEM, Volvo Penta and ZEM are putting their heads together to fuel the future of marine electromobility.

It will be important for traditional component players to be ready for this transformation toward e-mobility and to adapt quickly as the entire supply chain is drastically disrupted (McKinsey & Company). Critical components for electrification (such as batteries and electric drives) and autonomous driving (like light detection and ranging (LiDAR) sensors and radar sensors) will likely make up about 52 percent of the total market size by 2030.

5) Expanded charging infrastructures

To drive greater EV adoption, OEMs will need to work with CPOs to expand the availability of charging infrastructures, including fast-charging stations. A primary hindrance to consumer adoption is range anxiety and limitations on re-charging at convenient and frequent intervals. CPOs must simplify the charging experience for EV owners by providing access to ubiquitous, easy charging and supporting mobile apps to help drivers locate available charging stations. GM is helping to accelerate these infrastructures—”…the democratization of charging is vital to helping accelerate the mass adoption of electric vehicles.”

Enabling Engineering Breakthroughs Parker Lord is charging ahead toward the future of electrification and is ready to support their customers globally during this exciting shift in transportation. They infuse high-performance electrification solutions with world-class service and support. Their experts are highly responsive and specialized in custom formulations in multiple chemistries to meet your performance, cost, and schedule targets. If you have questions about how they can meet your electrification needs, reach out to a team member today! Contact them here.

[ad_2]

Source link